OUR MAIN FEATURES

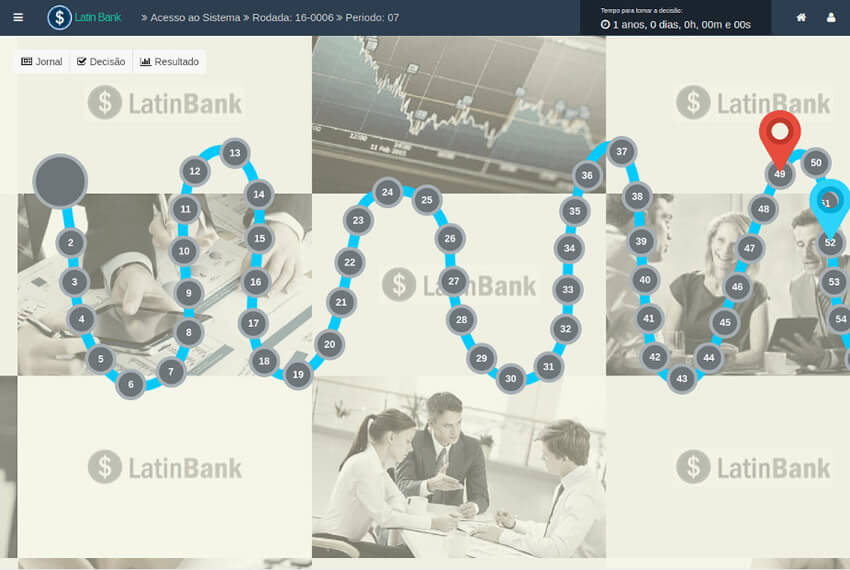

Simulator Differentials

We continuously innovate, bringing features to facilitate the teacher's work and the gameplay of the participants. Below we list some of the differentials that make us unique in the market.

Six Financial Market Areas

OGG’s LATINBANK business simulation covers these key financial areas: credit, foreign exchange, insurance, private pension, and banking services.

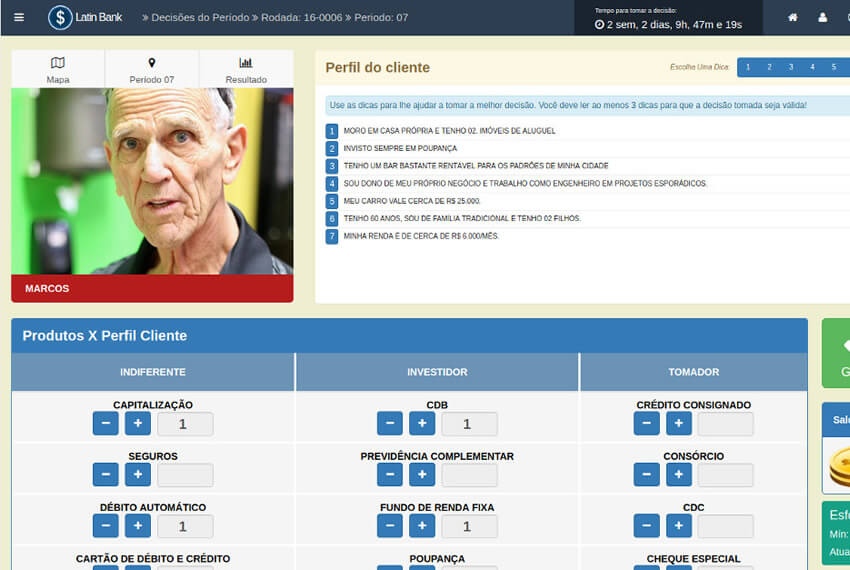

Different Customer Profiles

OGG’s LATINBANK business simulation promotes the proper selection of banking products and services according to prospective client's profile (investor, borrower or indifferent).

Wide Range of Applications

OGG’s LATINBANK business simulation includes a great variety of public and private client profiles, including freelancers and entrepreneurs.

Feedback Dashboard

OGG’s LATINBANK business simulation provides instructor control panels with detailed results from all players.

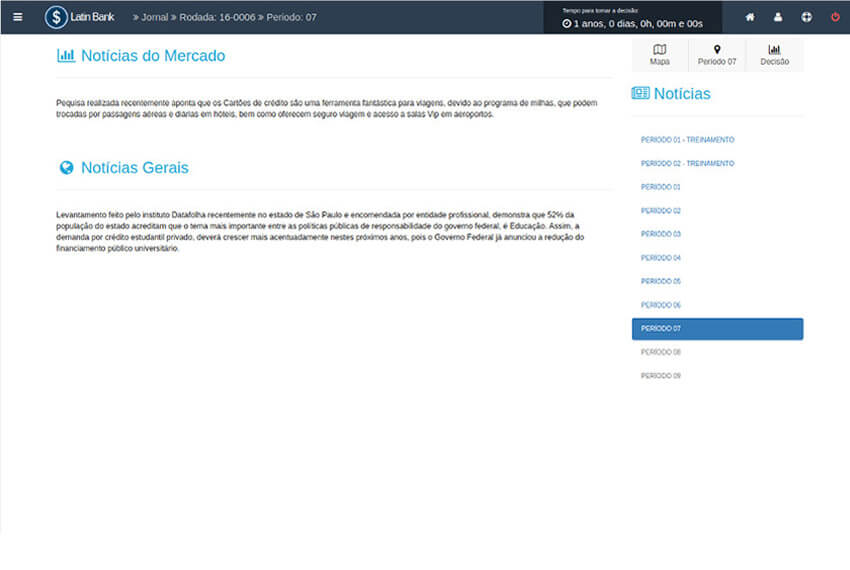

Macroenocomic Impacts

OGG’s LATINBANK business simulation includes built-in possible macroeconomic measures that could be taken by the Federal Government and would no doubt impact the play and results for each client profile.

Branding

OGG’s LATINBANK business simulation includes standard financial products and services in the business simulation, but partners may customize the game by adding their own products and services and brand name.